18+ paycheck calculator nh

New Hampshire Paycheck Quick Facts. Calculating paychecks and need some help.

Jobs Employment In Rochester Nh Indeed Com

Need help calculating paychecks.

. New employers should use. New Hampshire tax year. 0 5 tax on interest and dividends Median household income.

Supports hourly salary income and multiple pay frequencies. State of New Hampshire. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Estimate your take home pay after income tax in New Hampshire USA with our easy to use and up-to-date 2022 paycheck calculator. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for. If you earn normal wage there is no income tax.

So the tax year 2022 will start from July 01 2021 to. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. How to calculate annual income.

18 44 19 45 20 46 21 47 22 48 23 49 24 50. Use ADPs New Hampshire Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Integrated rate law calculator.

New Hampshire income tax rate. Back to Payroll Calculator Menu 2013 New Hampshire Paycheck Calculator - New Hampshire Payroll Calculators - Use as often as you need its free. Just enter the wages tax withholdings and other information.

For example if an employee earns 1500. Absolute max and min calculator. Payroll pay salary pay.

For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Cc to grams powder calculator.

Ratings for New Hampshire Paycheck Calculator. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New Hampshire. Calculate your New Hampshire net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New.

New Hampshire Hourly Paycheck and Payroll Calculator. Can claim state exemptions. No state-level payroll tax.

New Hampshire Hourly Paycheck Calculator. This free easy to use payroll calculator will calculate your take home pay. Use ADPs New Hampshire Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Census Bureau Number of cities that.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23395555/Screen_Shot_2022_04_17_at_9.39.29_PM.png)

Deep Dive Andres Cubas Eighty Six Forever

Small Business Employment And Wages Bouncing Back According To Latest Quickbooks Canada Data

New Hampshire Paycheck Calculator Tax Year 2022

Lower Whiteflood Farm Cottage In Owslebury Winchester Hampshire Book Online Hoseasons

18 Riverview Ter Hampton Nh 03842 Mls 4914041 Redfin

Hampton Courts Apartments Hampton Courts Apartments Washington Dc Rentcafe

Free Paycheck Calculator Hourly Salary Smartasset

Symmetry Software Offers Dual Scenario Calculators To Aid In Comparing Take Home Pay For Varying Deductions And Benefits

178 Main St Unit 2 Newmarket Nh 03857 Apartments 178 Main St Newmarket Nh Apartments Com

![]()

New Jersey Labor Laws Minimum Wage Laws 2022

The Cheney Companies 76 Exeter St Newmarket Nh Apartments For Rent Rent

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23440805/Draft_Value_JJ_RH_FS_JD.jpg)

Nfl Draft Pick Value Chart John Dixon S Av Based Model Arrowhead Pride

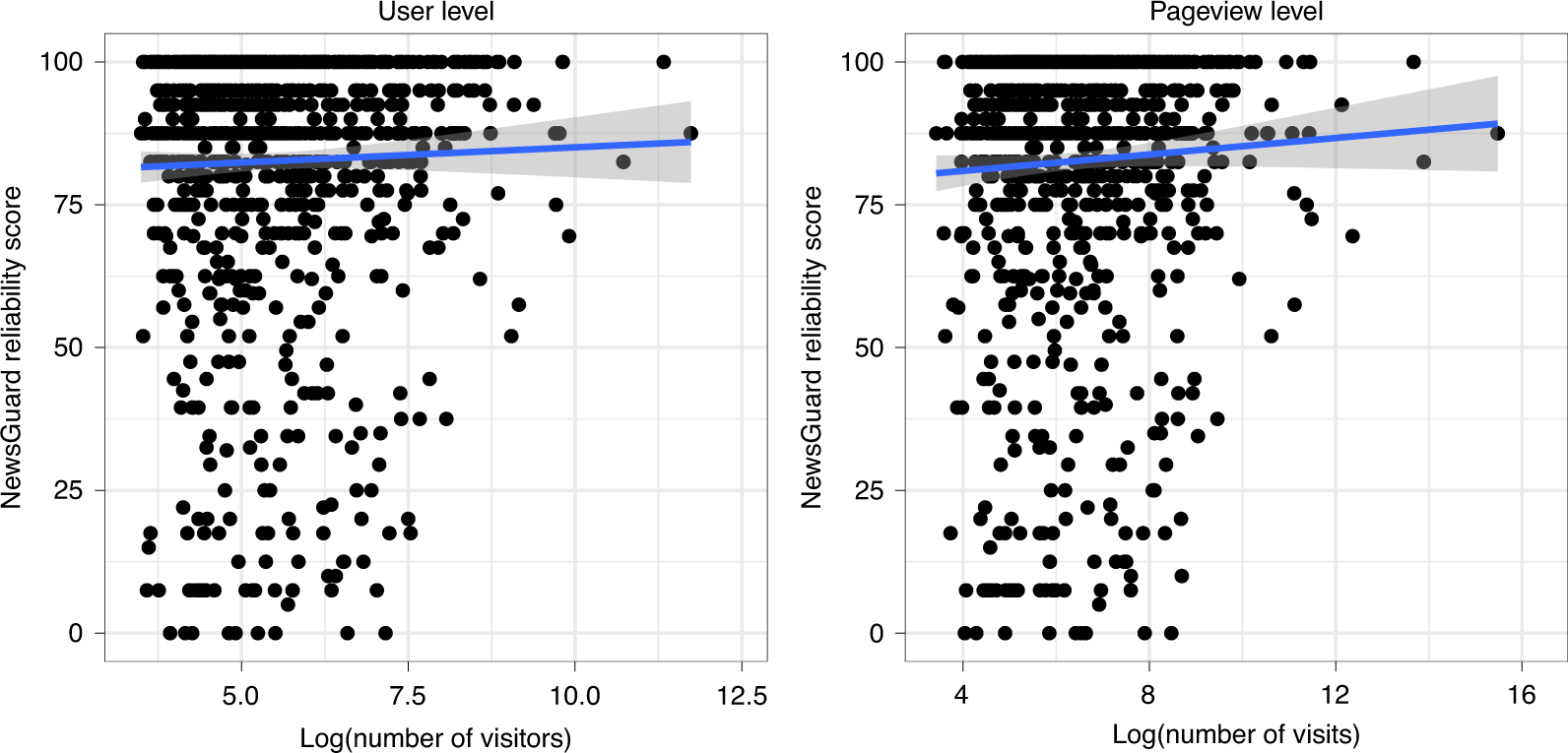

Political Audience Diversity And News Reliability In Algorithmic Ranking Nature Human Behaviour

New Hampshire Income Tax Calculator Smartasset

Keeping Nh In The Picture Seacoast Scene 04 29 2021 By Seacoast Scene Issuu

New Hampshire Paycheck Calculator Tax Year 2022

Free Paycheck Calculator Hourly Salary Usa Dremployee